Our Foundation

Our investment philosophy emerges from extensive education, study, and research. This rigorous approach has led us to embrace evidence-based investing over market speculation.

The investment landscape

Two primary investment methods

1

Active management - Stock picking

Professional fund managers attempt to beat the market through careful stock selection, market timing, and economic analysis. While appealing in theory, this approach typically involves higher fees and inconsistent results.

2

Passive investing - Index investing

A systematic approach that mirrors market performance by investing in diversified index funds. This method offers lower costs, broader diversification, and more predictable long-term results.

The Efficient Market Hypothesis (EMH)

The Efficient Market Hypothesis, or EMH, is a financial theory that suggests all available information about investments such as company news, economic data, or trends is already reflected in the prices of stocks and other assets.

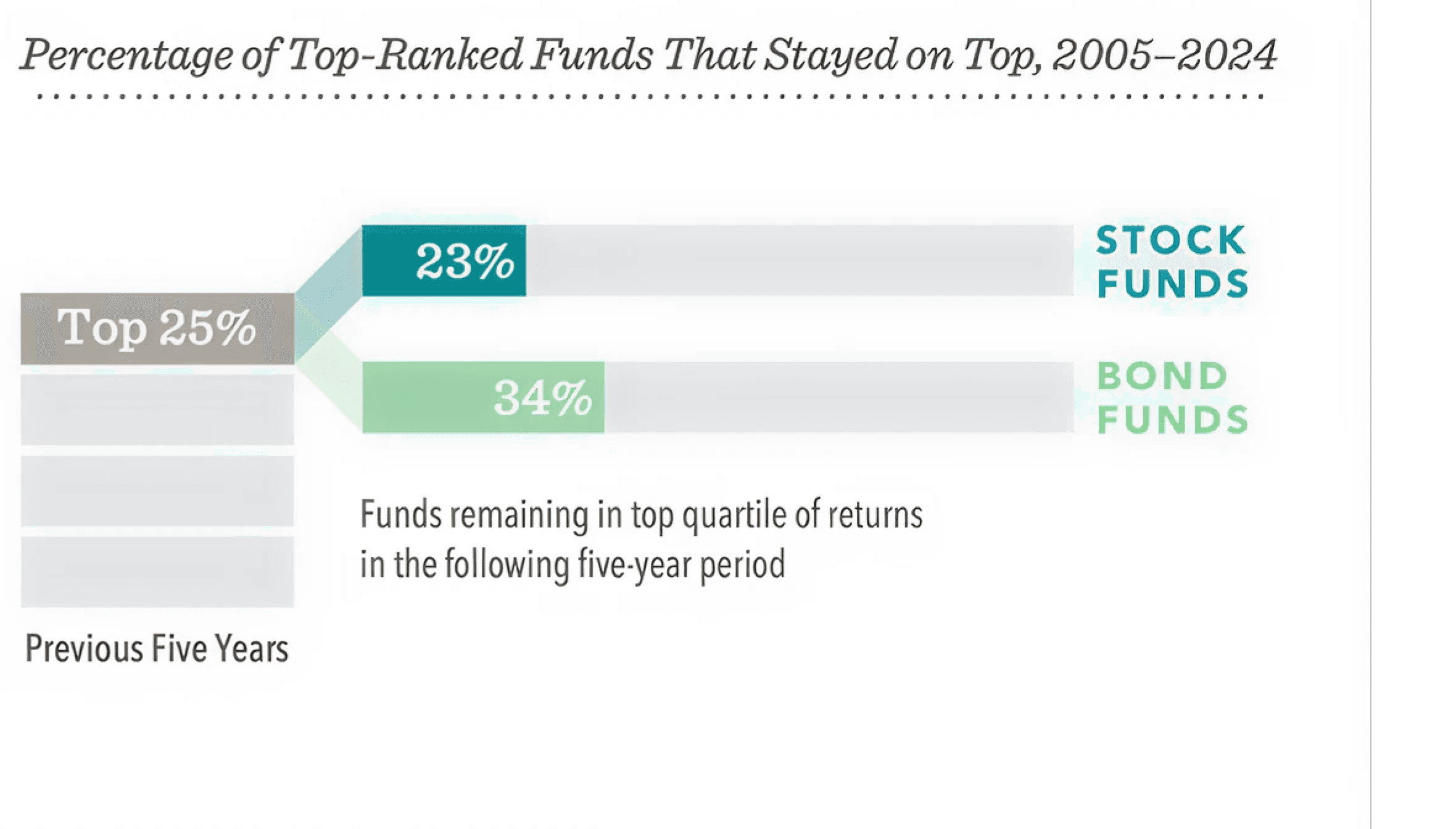

In simple terms: the market is always one step ahead. By the time you or anyone else hears good or bad news, it's likely already been factored into the price of the investment. This means it’s incredibly challenging, if not impossible, to consistently ‘beat the market’ by picking individual stocks or timing when to buy or sell. Many professional fund managers try to do this (active management), but research shows that most don't outperform the market over the long term, especially after fees (as shown above).

Systematic, evidence-based investing

Our preferred strategy

Built on decades of academic research and real-world data, systematic investing focuses on capturing market returns through:

Diversification

Spreading investments across thousands of companies, sectors, and countries

Strategic Asset Allocation

Optimizing investment mix based on your goals and risk tolerance

Long-Term Focus

Maintaining discipline through market cycles

Low Costs

Utilizing efficient index funds and evidence-based portfolios

Evidence-Led Decisions

Relying on research, not predictions

Why we choose this approach

1

Higher long-term success rates

Systematic investing benefits from overall market growth rather than attempting to predict winners, delivering more consistent results over time.

2

Lower investment costs

Reduced fees mean more of your money remains invested and working toward your goals.

3

Emotional Discipline

A systematic approach reduces the temptation to make poor decisions during market volatility.

4

Transparency

Clear, consistent rules ensure you always understand how and why your money is invested.

5

Goal alignment

We focus on what matters most: helping you achieve your personal financial objectives with confidence.

Financial Planning services

Comprehensive financial planning and cross-border tax guidance to investment management and protection strategies. Whether you're building wealth, planning retirement, or preparing for repatriation, our specialised approach ensures every aspect of your financial life works together seamlessly.